Taking a closer look at provincial and territorial budgets and what they could mean for food insecurity

April 13, 2023

Budget season has come to an end. The 2023-2024 federal, provincial, and territorial budgets come at a critical time where record inflation has put considerable financial strain on many Canadians. With 1 in 6 households struggling to affording food due to lack of money in 2021, the circumstances for these households have undoubtedly become more dire.

The policy interventions introduced in these budgets will be critical for household food insecurity because they play a significant role in whether or not Canadians have enough money for basic needs.

[Skip to section on individual provincial and territorial budgets]

Reflecting on the federal budget

In our reaction to the 2023 federal budget in The Conversation, we highlighted how the new one-time Grocery Rebate takes the right approach by providing cash directly to low-income households but falls short by not improving incomes enough or in an enduring way. We would’ve liked to have seen this approach taken to strategically enhancing the Canada Child Benefit, Canada Workers Benefit, and Employment Insurance for low-income Canadians.

Provincial and territorial policies matter for food insecurity

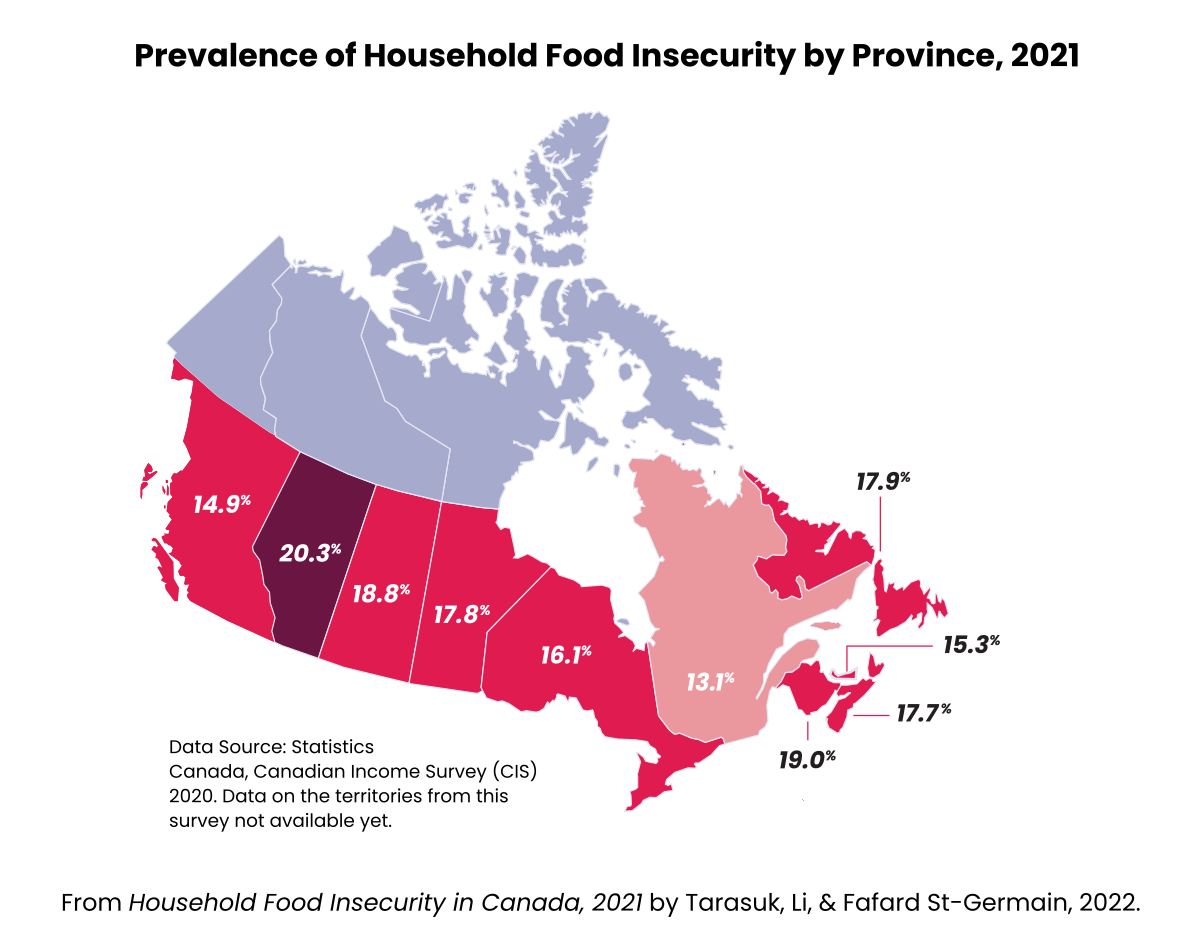

In 2021, there were notable differences in the prevalence of food insecurity across the provinces, pointing to the roles provincial and territorial governments play. Decisions on social assistance, minimum wage, income tax, child benefits, and other income supports are important ways in which governments contribute to the reduction or perpetuation of food insecurity in their jurisdictions.

We are now seeing the provinces and territories respond in different ways to the high rate of inflation and struggle of low-income households to afford food. Here we take a look at the income policies outlined in provincial and territorial budgets.

Reflecting on provincial and territorial budgets

Indexing income supports to inflation

Indexing income supports to inflation ensures that, at the very least, the amounts provided to households in need will keep up with rising cost of living. Most provinces and territories are increasing social assistance benefits to varying degrees in this year’s budgets, but only 4 jurisdictions index their rates —Quebec, Yukon, and most recently, New Brunswick as of 2021 and Alberta as of 2023.

Ontario will start indexing their disability benefit, ODSP, to inflation this year and Manitoba’s proposed new disability benefit will also be indexed, but that still leaves many programs and their recipients unprotected from inflation if governments don’t implement comparable increases.

It is not only social assistance benefits that should be indexed, but also other targeted income supports like provincial and territorial child benefits. Of the 11 jurisdictions with child benefits, only five now index them to inflation (Newfoundland and Labrador, Quebec, Ontario, and starting in 2023, Alberta and Yukon).

It is necessary to look at the full package of policies that affect the incomes of low-income households, regardless of how they earn their money, and use the policies to ensure people have enough money for basic needs.

Reconciling incomes and the cost of living

Indexation is only part of the picture, since social assistance rates remain too low in every province and territory, as illustrated by the high rate of food insecurity among households relying on these programs. In 2021, 63.1% of households relying on social assistance in the provinces were food-insecure, half of which were severely food-insecure.

It is not enough to index rates or occasionally provide increases to mitigate the impact of inflation; benefit levels and other income supports should be sufficient to cover the actual costs of living. Recent food costing initiatives in provinces like British Columbia, Ontario, and Newfoundland and Labrador show how little is left over for social assistance recipients after food and housing costs or, in some cases, how much they are short for food and housing, let alone other necessities.

More support needed for low-wage workers

The majority of food-insecure household rely on employment incomes. Some budgets have introduced enhancements to benefits that reach low-income working households, but policy action to increase minimum wage, reduce job precarity, and address racism in the labour market are also necessary.

Research has shown that increasing minimum wage can reduce the risk of food insecurity, with the benefits outweighing the potential impact on unemployment levels. Minimum wage is set to increase in every province and territory this year, except Nunavut and Alberta, which do not index minimum wage to inflation and have not seen increases since 2020 and 2018 respectively. Some of the increases in the other provinces will come from indexation, but Manitoba, Newfoundland and Labrador, Nova Scotia, Prince Edward Island, and Saskatchewan will see larger increases in 2023.

Reducing food insecurity could offset public health care spending and use.

Provincial and territorial governments are also committing large investments to strengthen healthcare systems, amidst a crisis of inadequate resources and access. Addressing food insecurity should be part of the discussion around health care, given the burden food insecurity has been shown to take on healthcare utilization and healthcare costs. Investments in policies that reduce food insecurity could also pay dividends for the health care system.

Looking beyond Budget 2023

Not enough action on income inadequacy

Rates of food insecurity have remained high in Canada because the policies around income supports and wages have not done enough to ensure all Canadians can afford the food they need. The increasing pace of inflation turns up the alarms on the need to reconcile wages, social assistance, and other income supports with the actual costs of living.

We have yet to see any government in Canada develop policies with the explicit objective of reducing the prevalence or severity of household food insecurity. If this was the goal, we would see policies in these budgets that go further to ensure people had enough money to meet basic needs.

Canada’s social safety net(work) and Basic Income

The social safety net in Canada is a patchwork of various federal, provincial, and territorial income supports and wraparound social services. While there are key programs like the Canada Child Benefit, Old Age Security and Guaranteed Income Supplement, and provincial/territorial social assistance, there are also many other policies that impact the incomes of low-income Canadians, like provincial child benefits and low-income tax credits. Many of these policies make appearances in this year’s budgets.

All of the budgets, whether federal, provincial, or territorial, are providing some more income support for low-income Canadians. However, many of the measures are temporary, limited to particular subgroups of low-income households (e.g., people with disabilities, families with children, seniors), or both. Critically, the measures are likely too small to offset the added burden of unprecedented rising costs of living, let alone address the income inadequacy underlying the persistently high rates of food insecurity.

A basic income that establishes an adequate income floor for all Canadians is a policy approach that we think merits more consideration.

We already have income-tested programs like the Canada Child Benefit, OAS/GIS, GST credit, and their provincial counterparts that have elements of a basic income. Provinces like Newfoundland and Labrador and Quebec are also introducing new targeted “basic income” programs for youth receiving residential services and social assistance recipients who are unable to work.

A more comprehensive basic income, a concrete floor paved through collaboration between all levels of government, could help address the inadequacy established by the design of existing social policies and reach the Canadians in need who have been left out.

A closer look at provincial and territorial budgets

Although policies around job training, affordable housing, healthcare access, and other social services and subsidies are important for households’ financial circumstances, we’re highlighting the major budget items announced as “affordability measures” that directly support the incomes of low-income households, those who are most negatively impacted by the rising costs of living.

These summaries are not exhaustive and we encourage readers to look at the full budget documents.

Alberta

Saskatchewan

Manitoba

Ontario

Quebec

New Brunswick

Nova Scotia

Newfoundland & Labrador

Prince Edward Island

Yukon

Northwest Territories

Nunavut

British Columbia

British Columbia’s 2023 budget includes multiple measures to increase the incomes of low-income British Columbians through their provincial child benefit, tax credits, and social assistance.

Social assistance

- BC’s social assistance programs (Income Assistance, Disability Assistance) will see an increase of $125 per month to the shelter component, which is limited to supporting housing costs. That means that some social assistance recipients in subsidized housing may not benefit from this increase.

- The earning exemptions will increase by $1200 per year.

BC Family Benefit

- A 10% increase to the BC Family Benefit starting July 2023. This permanent increase comes after temporary supplements to the provincial child benefit for the first three months of 2023.

- A new top-up supplement for single parents up to $500 annually.

Renter’s tax credit

- This new income-tested tax credit will provide low-income and moderate-income renters, including social assistance recipients, up to $400 annually.

Climate Action Tax Credit

- Increase to the maximum amount and income thresholds for the Climate Action Tax Credit. Most British Columbians received three one-time B.C. Affordability Credits in 2022-2023 through this credit as part of the government’s response to the rising cost of living.

It is promising to see policies targeting low-income families with children, single parents, renters, and social assistance recipients, all groups at higher risk of food insecurity, but more action is needed.

Although not indexed to inflation, the BC government has permanently increased income assistance rates several times since 2017, following a 10-year freeze (in September 2017, April 2019, and April 2021). Together, these increases have gone far beyond what would have been needed to keep up with inflation over those years. However, they still remain low in comparison to the costs of living in the province.

The 2022 food costing by Provincial Health Services Authority showed that a single parent with a child on income assistance would be short $112 for food and housing, while a single adult on disability assistance would be short $210. A family of four on income assistance would only have $312 left over after food and rent for all of their other necessities.

We remain concerned that the continued public funding of food banks in BC will further entrench food charity as a policy response to food insecurity. The budget’s $200 million commitment to “food security initiatives” will fund food banks, food producers, food processers, and other food distributors. While supporting sustainable local food production may be important for improving the food supply chain and the local economy, doing so is not a solution to food insecurity.

As described in our letter to the consultation for a national school food program, there is no evidence for school food programs as a solution to food insecurity among children. The framing of $214 million investment in BC’s school food programs as “addressing student hunger” detracts from efforts to build universal, equitable programs that meet student’s nutritional and education needs. It also silences discussions on how the province could do more to reduce food insecurity for families with children through enhancements to social assistance and other income supports.

Alberta

Alberta’s 2023 Budget includes several measures announced in December 2022 as part of the Affordability Action Plan, such as the re-indexation of social assistance benefits, income tax brackets, and tax bracket thresholds, and temporary cash transfers for seniors, families with children, and social assistance recipients for the first 6 months of 2023.

Social assistance

- After de-indexing social assistance benefits in 2019, the Alberta government began re-indexing Assured Income for the Severely Handicapped (AISH), Income Support and Alberta Seniors Benefit, increasing by 6% in January 2023.

Income tax

- After de-indexing personal income tax bracket thresholds and basic personal amounts in 2019, the Alberta government will begin re-indexing with the 2022 tax year.

Alberta Child and Family Benefit

- The provincial child benefit will now be indexed to inflation, increasing by 6% in February 2023.

Temporary affordability payments

- Families with children under 18 with household incomes under $180,000 can apply for $100 per month per child for 6 months.

- Seniors who have household incomes under $180,000 and do not receive the Alberta Seniors Benefit can apply for $100 per month for 6 months.

- Social assistance recipients will automatically receive $100 per month for 6 months.

While indexation to inflation for social assistance, child benefit, and income tax brackets will help mitigate the burden of rising prices on low-income households, it doesn’t address chronic income inadequacy in the province. It is a valuable start, but more substantial enhancements to the social assistance programs are needed to ensure recipients can afford basic needs.

The measures outlined in this budget also provides little or no relief for low-income, working-age Albertans without children. Other benefits that could’ve been expanded include the rent assistance and temporary rent assistance benefits.

Alberta is also one of the provinces providing public funding towards food charity in their 2023 budget to “provide food security for vulnerable Albertans” — $10 million over 2 years, with an additional $10 million to match private donations. Food charity is unable to address the root causes of food insecurity, but effective policy making can. We hope to see the Alberta government commit to continued efforts towards a more effective social safety net instead of misguidedly expecting food charities to manage widespread food insecurity.

In 2021, Alberta had the highest rate of food insecurity among the provinces, with 1 in 5 households being food-insecure. The province also had the highest rate of severe food insecurity at 6.3%, meaning almost of a third of the food-insecure in Alberta are experiencing the most toxic level.

Saskatchewan

Saskatchewan’s 2023 budget saw some increases to the primary programs supporting low-income households, which comes on the heels of a one-time $500 Saskatchewan Affordability Tax Credit (SATC) that went to all Saskatchewanians 18 and over, regardless of income.

- An increase of $60 per month ($30 for the Adult Basic Benefit and $30 for the Shelter Benefit) for Saskatchewan Income Support (SIS) recipients. For a single person living in Saskatoon/Regina, that approximately amounts an increase of 6.6%, which was the annual average inflation rate.

- An increase of $30 per month for the Living Income Benefit component of the Saskatchewan Assured Income for Disability (SAID) program. For a single person living in Saskatoon, that approximately amounts to an increase of 2.8%.

Seniors Income Plan (SIP) benefit

- A $30 increase to the maximum monthly amount of this benefit for low-income seniors to $360 per month.

The increases to social assistance are positive steps, but they are not nearly enough to address the inadequacy of these programs. Moreover, the failure to index benefits to inflation in this budget is a missed opportunity. In 2021, 80.2% of households relying on social assistance in Saskatchewan were food-insecure.

Other missed opportunities include increases to the Saskatchewan Housing Benefit and Low-Income Tax Benefit (recently re-indexed in 2021. following a freeze since 2017), which could reach low-income households outside of social assistance programs. Saskatchewan is one of two provinces, alongside Prince Edward Island, without some form of provincial child benefit. In 2021, 22.5% of children under 18 in Saskatchewan lived in food-insecure households.

Manitoba

Manitoba’s 2023 budget includes changes to income taxes to lower tax burden and a new one-time benefit. Since the housing part of social assistance is indexed to the median market rent, recipients will see some increase to benefit amounts.

Carbon Tax Relief Fund

- A one-time, income-tested benefit of $225 per single person and $375 per couple for those with household incomes below $175,000.

- This benefit is the third one-time benefit in response to inflation. The previous two provided benefits for families with children and seniors.

Social Assistance

- The Rent Assist benefit, which goes to both social assistance recipients and low-income households not receiving social assistance, is indexed to the median market rent. Based on the changes in the rental market, recipients will see an average increase of 3% for the benefit, which amounts to a maximum of $16-$33 per month depending on household size.

- The 2023 budget saw no additional increases to the Employment and Income Assistance (EIA) program, following a small 2022 increase of $50 per month for single recipients, amounting to a 6.5% increase and an additional $25 per household per month for recipients with a disability.

New Manitoba Supports for Persons with Disabilities

- A new income support program that provides income assistance recipients with severe, long-term disabilities an additional $100 per month, additional allowances for phone and laundry services, and a higher annual earnings exemption of $12 000.

- The new benefit will be indexed to inflation.

Income tax

- Increases to the basic personal amount and income tax brackets will see fewer low-income households having to pay provincial income tax.

The indexation of the new disability income support program signals a recognition that indexing benefits to inflation is a critical policy design element that ensures benefits are not eroded over time. That recognition remains missing from basic amounts of the EIA and EIA-disability benefits, which had remained stagnant for two decades. It is worth noting that Rent Assist had been frozen for some single working-age adults from 2019 to 2021. In 2021, 71.1% of households relying on social assistance were food insecure, pointing to the need for more substantial increases.

The budget was also a missed opportunity to increase and index the Manitoba Child Benefit, an income-test benefit for low-income working families, and the 55 PLUS Program for low-income adults over 55 years of age.

Ontario

Ontario’s 2023 budget includes a temporary increase to the provincial senior benefit and future indexation to inflation, as well as funding for the previously announced increase and indexation of the Ontario Disability Support Program (ODSP)

Social assistance

- In 2022, ODSP saw a 5% increase to the core benefits that make up most of the program. Starting in July 2023, the core ODSP benefits will increase with inflation due to indexation. However, some components, such as the Special Diet Allowance or pregnancy/breast feeding nutritional allowance, did not increase or get indexed to inflation.

- The earning exemptions was increased from $200 to $1000 per month, but the clawback rate was also increased from $0.50 to $0.75 per dollar.

Guaranteed Annual Income System (GAINS)

- The provincial low-income senior benefit will be temporarily doubled for 12 months.

- In July 2024, the program will be expanded to increase the number of eligible seniors.

- There is a plan to index the benefit to inflation.

The absence of any increase to the Ontario Works (OW) program, Ontario’s general social assistance program, is very concerning. Food costing by public health units across Ontario have shown that the rates for OW are not sufficient to meet the costs of basic necessities in their regions, especially for single, unattached adults. In Toronto, a single, unattached adult receiving Ontario Works (OW) would be short $1,380 per month for rent, food, and transportation, let alone other essentials.

OW has not seen an increase since 2018 and is now among the few Ontario benefits not indexed to inflation, given the proposal to index GAINS in the future. The Trillium Benefit and Ontario Child Benefit (OCB) are already indexed.

The other benefit not indexed is the Low-Income Individuals and Families Tax (LIFT). This benefit could have been enhanced to provide some support for low-wage workers, a group that has not seen any targeted relief in this budget.

Given the increased risk of food insecurity for working-age adults and their families, the province should prioritize increases to OW and ODSP and benefits like OCB and LIFT.

Quebec

Quebec’s 2023 budget includes an increase to part of their low-income tax credit, the Solidarity Tax Credit, reductions to the income tax rate for low-income households, and a new basic income program for people unable to work, in addition to the expected increases from indexation to inflation for provincial income supports like the provincial child benefit and social assistance programs.

Solidarity Tax Credit

- The refundable tax credit for low-income households in Quebec consists of three components with different eligibility criteria. The housing component, which is provided to low-income homeowners or renters not in subsidized housing, will now be indexed to double the rate of inflation. In 2023, the component will see an increase of 12.88%.

Income tax

- A 1% decrease to the income tax rate for the lowest two income brackets (<$49,275 and between $49,275-$98,540). Previous research on provincial policies found that a lower tax rate for the lowest income bracket was associated with reduced food insecurity.

New “Basic Income” Program

- Quebec is introducing a new social assistance program in 2023 for Social Solidarity recipients with disabilities that have prevented them from being able to work for most of the previous 6 years. The change will provide eligible recipients with an additional $4116 per year for single people and $7884 per year for couples, on top of Social Solidarity amounts.

Social assistance

- Increases to the Social Assistance and Social Solidarity programs from indexation to inflation.

Family Allowance

- An increase to the provincial child benefit from indexation to inflation.

Since the increase to the Solidary Tax Credit is only to the housing component, it has received criticism for not providing a sufficient increase to support low-income Quebecers, since it amounts to approximately a 3% increase overall to the credit. As well, it only benefits those eligible for the component.

Quebec has stood out in recent food insecurity statistics as having the lowest prevalence, at 13.1% in 2021. Research has repeatedly found that living in Quebec is associated with lower risk of food insecurity, which warrants more detailed study. Although almost all the provincial social supports are indexed to inflation, 59% of household relying on social assistance in the province were food-insecure in 2021, pointing to the need for further increases.

The 2023 Quebec budget also includes $30.0 million for food charity to “improve food security” — $20 million over four years to build storage infrastructure and $10 million to support food aid organizations in purchasing food. This funding comes after a provision of $6 million to food charity in December 2022. The government’s continued focus on funding food charity is ill-founded in light of the evidence for income-based policy interventions.

New Brunswick

New Brunswick’s 2023 budget includes increased funding to social assistance from the indexation to inflation introduced in 2021. The increases to social assistance were highlighted in this years budget as part of the province’s response to rising costs of living, which also included the 2022 Emergency Fuel and Food Benefit that provided $450 for low-income individuals or $900 for families in 2 one-time payments.

Social assistance

- An increase of 3% to social assistance rate from the previously implemented indexation.

The introduction of indexation in 2021 is important because it helps prevent social assistance rates from becoming even more inadequate. However, it does little to improve the material circumstances of recipients. For that, it would require the government to reconcile rates with the actual costs of living. In 2021, 71.7% of households relying on social assistance in New Brunswick were food-insecure.

The New Brunswick HST credit, New Brunswick Child Tax Benefit, New Brunswick Working Income Supplement, and Low-Income Seniors’ Benefit are other income-tested provincial benefits that could have been used to target more income support for low-income households through both amount increases and indexation.

The budget also included changes to income taxes, both in the brackets and rate. The lowest income bracket will now include a slightly higher incomes but saw no change in the tax rate.

Nova Scotia

Nova Scotia’s 2023 budget includes an increase to the Nova Scotia Child Benefit and increases to funding for disability programs, but little in terms of other supports for low-income families.

Nova Scotia Child Benefit

- An increase of approximately $200 per year to the Nova Scotia Child Benefit.

Disability Support Programs

- The funding for provincial disability program will increase by $23.3 million, but it has not been announced what the extra funding will mean for benefit amounts.

Following some support for social assistance recipients in early 2022 in the form of one-time payment of $150, Budget 2023 provides no changes for Income Assistance recipients. The lack of increase in benefit amounts during this period of record inflation is disappointing, given how low the amounts already are and how likely social assistance recipients are to be food-insecure. In 2021, 74.1% of households relying on social assistance in Nova Scotia were food-insecure. Increases to bring benefit amounts to a more adequate level and indexation to inflation are urgently needed.

Besides increasing the Nova Scotia Child Benefit, there are other policies that the province could have leveraged to better support to low-income Nova Scotians — the Poverty Reduction Credit, a tax-free credit for Income Assistance recipients without children, and the Nova Scotia Affordable Living Tax Credit (ALTC), a tax-free credit for low-income individuals and families. The Poverty Reduction Credit has seen some increases over the years since its introduction in 2010 (in 2012 and 2018). The ALTC was indexed to inflation when first introduced in 2009, but an amendment in 2014 ended indexation and the credit amount has not changed since. Neither saw any increase in this year’s budget.

“We’re especially concerned to see zero increase in provincial Income Assistance rates, which is the main source of income for 42% of folks accessing support at food banks. Income support is one of the most assured and impactful ways to reduce food insecurity. Without at least indexing the existing Income Assistance rates to inflation, Nova Scotians experiencing food insecurity will see the real value of their dollars not only stay stagnant—but actually diminish—this year.” – Feed Nova Scotia

Read Feed Nova Scotia’s full response to the provincial budget.

PEI

Due to the provincial election, there was no provincial budget tabled at this time.

Newfoundland & Labrador

Newfoundland and Labrador’s 2023 budget includes increases to low-income tax credits and follows a one-time, income-tested cost-of-living benefit of up to $500 in 2022. Part of the increased funding for the social assistance program (Income Support) in the budget would have been for the 5% increase in the basic support amount in November 2022.

Refundable low-income tax credits

- A 5% increase to the NL Income Supplement (not to be confused with the social assistance program, Income Support). The income-tested benefit provides up to $520 for single adult or $1,051 for a couple with 2 children per year.

- A 5% increase to the Seniors’ Benefit. The income-tested benefit provides low-income seniors with up to $ 1516 per year.

Basic Income Program for Youth Receiving Residential Services

- This budget includes funding for the basic income program announced in October 2022 that provides additional financial supports and enhance wraparound services for youth between 16 and 21 receiving residential services.

As Food First NL has pointed out, the 5% increase to social assistance rates is not enough to make up for last year’s inflation, let alone previous years. Indexation to inflation would be an important enhancement for the social assistance program, but the rates would also need to be set to a more adequate level as well.

A comparison between income support amounts and food costing in province illustrates how the little money would be left over for income support recipients after the cost of a nutritious food basket (a standardized estimate of the cost of healthy eating). The province had previously indexed social assistance from 2016 to 2012, as part of the 2006 poverty reduction strategy credited with the most drastic recorded reduction in provincial food insecurity.

The province already recognizes the importance of indexation, given the indexation of the NL Child Benefit, and should move to index other provincial supports like Income Support, Income Supplement, Seniors’ Benefit, and Prenatal Infant Nutrition Supplement. We hope to see these changes introduced as part of the upcoming Social and Economic Well-Being Plan and Income Support review, as recommended in our joint submission with Food First NL, Nourish, and the Coalition for Healthy School Food.

Asides from the basic income program for youth, an all-party in the House of Assembly is also currently studying the potential of a guaranteed basic livable income for Newfoundland and Labrador, a policy approach recommended by the Health Accord NL as a way to support health and well-being.

“We got a 5% boost this past fall, but that doesn’t even catch you up to the CPI last year and we haven’t pegged it for years, so you know effectively for folks who are relying on social assistance, they’re getting a cut every year for almost a decade.” – Josh Smee of Food First NL on CBC’s On The Go with Anthony Germain.

Listen to the rest of Josh’s reaction to the provincial budget

Yukon

Yukon’s 2023 budget includes increases to social assistance and the indexation of the Yukon Child Benefit.

Social assistance

- An increase of $100 per month to social assistance, which is already indexed to inflation. Social assistance in Yukon. This increase comes following a one-time $150 payment to social assistance recipients and Yukon Seniors Income Supplement recipients in late 2022 as part of inflation relief.

Yukon Child Benefit

- Funding has been allocating to increasing the Yukon Child Benefit to match inflation. The Confidence and Supply Agreement between the Yukon NDP and Liberal Caucus supporting the 2023 budget includes a commitment to index the territorial child benefit moving forward.

The Confidence and Supply Agreement also includes a comprehensive review of social assistance, set to begin in summer 2023. Although Yukon has indexed social assistance benefits for some time, it remains inadequate for many recipients.

The upcoming review should consider the high prevalence of food insecurity among social assistance recipients and introduce measures to reduce it. In additional to larger increases to bring benefit amounts to a level sufficient for basic needs, there are additional policy design elements that the government could act on, such as indexing the Yukon Supplementary Allowance for social assistance recipients with disabilities.

Northwest Territories

The Northwest Territories’ 2023 budget supports a redesign to social assistance programs in the territories that comes after the 2022 review.

Social assistance

- An increase to Income Assistance amounts based on the new Market Basket Measure – North (MBM-N), the current official measure of poverty, and increase to the earning exemptions.

- A new program for peoples with disabilities and seniors.

Details about the revised social assistance programs have yet to be released and it is unclear how the new Income Assistance amount will compare to MBM-N and if it will be indexed to inflation. Nonetheless, efforts to make the program more adequate are long overdue, as recognized in Minister Simpson’s Income Assistance Review Update.

In addition to indexing income assistance, the Northwest Territories government should also index the Northwest Territories Child Benefit program and increase the amount provided to families with children between ages 6 and 17 to recognize the reality of high rates of household food insecurity among children over 6 years of age. The territorial child benefit currently provides more to families with younger children.

Nunavut

The 2023 Nunavut budget includes a $7 million increase to the Income Assistance program funding, but it has not been stated what that will look like for recipients. There will also be a new refundable tax credit based on funds from the carbon tax.

Nunavut has long had the highest prevalence of food insecurity in Canada. While investment for increasing benefits for Income Assistance recipients is a positive step, more is needed to address food insecurity in the territory. Increasing the Nunavut Child Benefit, indexing it to inflation, and removing the minimum earnings requirement could help to support food-insecure households with children.